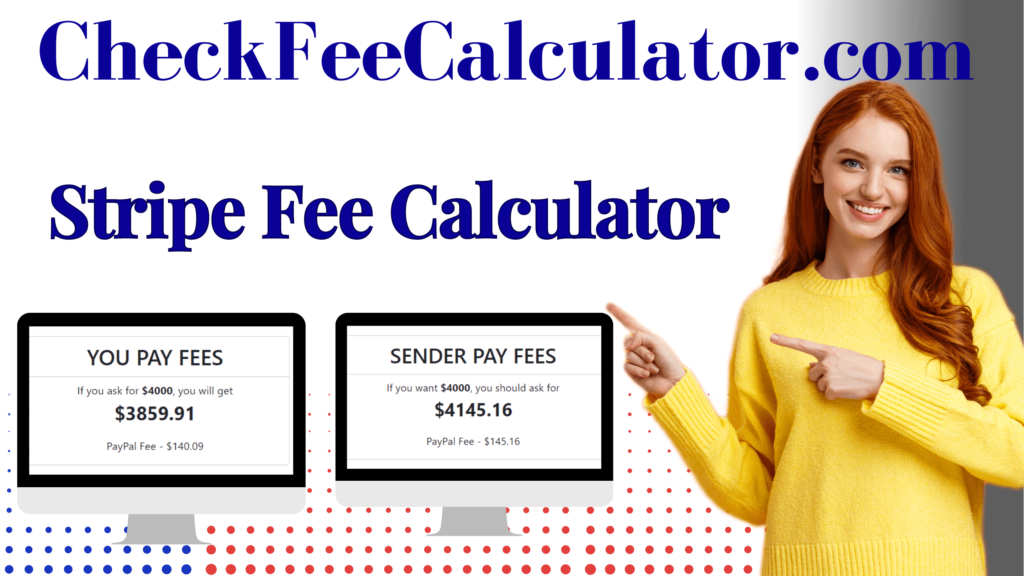

Stripe Fee Calculator Calculate Transaction Fees - CheckFeeCalculator.com

Use CheckFeeCalculator.com free Stripe fee calculator to calculate transaction fees for receiving money via Stripe.

Stripe Fee Calculator - Australia

Introduction: Are you tired of manually calculating your transaction fees and creating invoices? Do you want to simplify your transactions and save time? If so, the Stripe fee calculator is the perfect solution for you. With this powerful tool, you can easily calculate your transaction fees and create professional invoices in just a few clicks. In this article, we will explore how the Stripe fee calculator works and how it can benefit your business.

PayPal Australia Calculator

If you want to use Stripe to receive money or issue invoices to your clients, it's important to understand the transaction fees that come with each Stripe charge. Fortunately, there's an easy way to calculate these fees using the free Stripe fee calculator available at CheckFeeCalculator.com. With this tool, you simply enter the amount of the transaction and the calculator will display the total Stripe fees that you'll need to pay, including the 2.9% transaction fee and the $0.30 per transaction fee. This is a great way to ensure that you're pricing your services or products appropriately and that you're not losing money on each transaction. So the next time you use Stripe, make sure to take advantage of this helpful tool and accurately calculate your fees.

What is a Stripe Fee Calculator?

It is a Free tool used to calculate the processing fee for transactions made through the Stripe payment gateway. This fee is charged for every transaction and covers the cost of stripe processing, such as verifying the card details and transferring the funds to the seller's account. The processing fee is usually 2.9% of the total invoice amount plus a fixed amount of 0.30 per transaction. The processing fees can be costly for businesses that carry out a large volume of transactions, which makes it important to accurately calculate the fees associated with each transaction. By using a Stripe fee calculator, merchants can easily determine the amount of fees they will be charged and factor that in when pricing their goods or services.

How much Does Stripe Charge Processing Fee?

Stripe is an online payment platform that charges processing fees for transactions made on its platform. The processing fee for each transaction is 2.9% of the total amount paid, plus an additional fee of $0.30 per transaction. For example, if an invoice is paid for $100, the processing fee would be $2.90 + $0.30, equaling $3.20 in total. The processing fees can vary depending on the country the payment is being made from, with some countries having a slightly different fee structure. It is important for businesses to keep these fees in mind when using Stripe for online payments, as they can add up quickly over time. However, many businesses find the convenience and ease of use that Stripe provides to be worth the processing fees.

How to Calculate Stripe Processing Fees?

If you are using Stripe to manage your online payments, it is important to understand how Stripe processing fees work. The fee for processing a transaction through Stripe is 2.9%, plus an additional fee of 0.30 per transaction. To calculate these fees for a particular transaction, you simply multiply the amount of the transaction by 2.9%, and then add 0.30 to it. For example, if you process an invoice for $100 through Stripe, the processing fee would be $3.20 (2.9% of $100 = $2.90 + $0.30). It is important to keep these fees in mind when setting prices for your products or services, to ensure that you are pricing appropriately to cover the cost of Stripe processing.

What countries does stripe support?

As a global payment processor, Stripe supports a wide range of countries. Currently, Stripe offers support for over 40 countries around the world including the United States, Canada, United Kingdom, Japan, Australia, and most countries in Europe. Stripe's global coverage ensures that businesses can accept payments from virtually any customer, regardless of their location. In addition, Stripe offers a variety of payment methods, including credit cards, debit cards, digital wallets, and local payment methods. This makes it easier for customers to make payments using their preferred payment method. Stripe also offers support for multiple currencies, allowing businesses to accept payments in their local currency and expand their reach globally. Stripe's commitment to global support for payment processing is one of the reasons it is a popular choice for businesses of all sizes, from small startups to large enterprises.

Benefits of Using CheckFeeCalculator.com online calculator to calculate stripe fees

CheckFeeCalculator.com is a free online calculator tool that can be used to calculate Stripe fees quickly and accurately. It is a great resource for businesses who need to know the exact cost of their stripe transactions. The calculator takes into account all fixed fee and processing fees applicable to US Stripe accounts, as well as any additional fees which may be applicable at the time of payment. This allows businesses to easily budget for their Stripe transactions and reduce their Stripe fees. When using Check Fee Calculator tool you will be able to determine the exact cost of your transaction, including the 2.9% transaction fee, so you don’t have to worry about any hidden costs or surprises. With this calculator tool, you can easily reduce stripe fees by making sure all costs are accounted for in advance. CheckFeeCalculator.com is the perfect solution for businesses looking for an easy and accurate way to calculate Stripe fees with a free Fees Calculator!

Stripe fee calculator Australia

The Stripe fee calculator Australia is an essential tool for any business looking to accept online payments. With its advanced algorithm, it accurately calculates the fees associated with Stripe transactions, including currency conversion fees and subscription fees. The calculator takes into account various factors, such as transaction volume and location of the customer, to provide a precise breakdown of fees. This level of detail is crucial for businesses to make informed decisions about pricing and profitability. Utilizing the Stripe fee calculator can help businesses minimize costs and maximize profits, improving their overall financial health. Additionally, the calculator is easy to use and customizable, allowing businesses to adjust settings and see the impact on fees in real time. Overall, the Stripe fee calculator Australia is an invaluable resource for businesses operating in the digital age, providing them with the necessary information to navigate the complex world of online payments.

How Does Stripe Fee Calculator Work?

The Stripe fee calculator is a tool that allows merchants to calculate the fees associated with every transaction processed on the platform. The calculator takes into account various factors, such as the transaction amount, the location of the customer, and the type of payment method used. By using the Stripe fee calculator, merchants can determine the exact amount they'll be charged for each transaction.

What are the Fees Charged by Stripe?

Stripe charges a fee for every transaction processed on its platform. The fee varies depending on the type of transaction and the location of the customer. In the US, the fee for processing credit and debit card payments is 2.9% + $0.30 per transaction. For international payments, the fee can go up to 3.9% + $0.30 per transaction. Additionally, Stripe charges a fee of 0.4% for ACH payment

Benefits of Using Stripe Fee Calculator?

There are several benefits of using the Stripe fee calculator:

⦁ Accuracy: The calculator provides accurate fee calculations, allowing merchants to make informed decisions.

⦁ Cost-saving: By knowing the exact fees, merchants can optimize their pricing strategy and reduce their costs.

⦁ Transparency: The calculator provides complete transparency, ensuring that merchants know exactly what they're paying for.

How to Use the Stripe Fee Calculator

Using the Stripe fee calculator is straightforward. Follow these simple steps:

1. Go to the Stripe website and log in to your account.

2. Click on the "Calculator" tab.

3. Enter the transaction amount and select the currency.

4. Choose the location of the customer.

5. The calculator will display the fees associated with the transaction.

How to Reduce Stripe Fees?

While Stripe transaction fees are competitive, they can still add up over time. Here are some tips to help you reduce your Stripe transaction fees:

Tip 1: Negotiate Lower Fees

If you are a high-volume merchant, you may be able to negotiate lower transaction fees with Stripe. Contact Stripe's sales team to discuss your options.

Tip 2: Encourage Customers to Use ACH Payments

ACH payments are cheaper than credit card payments on Stripe. Encourage your customers to use ACH payments whenever possible.

Tip 3: Use Stripe's Fraud Detection Tools

Stripe offers a suite of fraud detection tools that can help you reduce chargebacks and disputes. By reducing chargebacks and disputes, you can reduce your transaction fees.

Conclusion:

In conclusion, the Stripe fee calculator is a valuable tool for merchants and business owners looking to understand the fees associated with transactions processed on the Stripe platform. By using the calculator, merchants can optimize their pricing strategy and reduce their costs, resulting in better profits. So, if you're a Stripe user, make sure to take advantage of this valuable tool.

Frequently Asked Questions

1. How do I access the Stripe calculator?

To access the Stripe fee calculator, log in to your Stripe account and click on the "Calculator" tab. From there, you can enter the transaction details and get an accurate fee calculation.

2. What payment methods does Stripe support?

Stripe supports a range of payment methods, including credit and debit cards, ACH payments, and mobile wallets like Apple Pay and Google Pay.

3. Are there any hidden fees associated with Stripe?

No, Stripe is transparent about its fee structure, and there are no hidden fees associated with using the platform. The fees are clearly outlined in the pricing section of the Stripe website.

4. How long does it take for funds to be transferred to my bank account?

Funds transferred to your Stripe account are usually available for transfer to your bank account within 2 business days. However, the exact transfer time may vary depending on your bank.

5. Can I use Stripe for international transactions?

Yes, Stripe supports international transactions and allows merchants to accept payments from customers worldwide. However, fees for international transactions may be higher than domestic transactions.

6. How much fees does Stripe charge per invoice?

Stripe charges 2.9% + 30¢ per successful transaction for invoicing. There are no additional fees for failed transactions, refunds or chargebacks.

7. Do Stripe fees vary depending on the country?

Yes, Stripe fees vary depending on the country. Depending on the country, Stripe may charge different processing fees as well as other taxes and fees. Additionally, Stripe also supports multiple currencies for international payments.

8. Stripe Fee Calculator UK

The Stripe Fee Calculator UK is a tool used to calculate the fees for processing payments through Stripe in the UK. It takes into account factors such as the amount of the payment and the type of card used to make the payment.

9. Stripe Fee Calculator Euro

The Stripe fee for transactions in Euro is 0.25% + €0.25 per successful charge.

10. What are Stripe processing fees?

Stripe is an online payment processor that lets you charge your customers via Stripe. For each transaction processed, Stripe charges a fee based on the total amount.

11. How much does Stripe charge?

The standard Stripe processing fee is 2.9% plus $0.30 per transaction. For example, if a customer pays you $100, the fee will be $3.20. If a customer pays you $1,000, the fee will be $29.30.

12. Do they charge any additional fees?

As far as Stripe transaction fees go, this is pretty much it. However, there are a few things to keep in mind. If you're a US-based Stripe user charging US credit cards, there are no additional fees. If you're charging international cards, there's an additional 1% fee.

13. How can I reduce Stripe fees?

If you're a business owner who wants to reduce Stripe fees, there are a few things you can do. You can use a free Stripe fee calculator to determine how much you'll be charged for each transaction. You can also consider calculating individual payments instead of grouping them together on an invoice to reduce fees. Additionally, you could encourage customers to use ACH payments, which have lower fees than credit card transactions.

14. Is there a fee to use Stripe?

There is no fee to use Stripe. However, they do charge processing fees for each transaction.

15. What is Stripe's fixed fee?

There is no fixed fee for Stripe. The fee is based on a percentage of the total transaction amount and a per-transaction fee.

16. Does Stripe offer a fee calculator tool?

Yes, Stripe does offer a fee calculator tool. This calculator makes it easy to determine how much you'll be charged for each Stripe transaction.

17. Is Stripe fee of 2.9% is the only fee for Stripe?

This is the standard Stripe processing fee, but keep in mind that fees may vary depending on a number of factors, such as the country you're in and the types of cards you're processing. Additionally, there may be other fees associated with using Stripe, such as chargeback fees or fees for other services they offer.

18. Can I charge my customers via Stripe?

Yes,

19. Stripe fee calculator CanadaStripe fee in Canada for credit card payments is 2.9% + $0.30 CAD per successful transaction.

For international payments, there may be additional fees depending on the country of origin/destination and currency conversion.

20. How does the Stripe calculator work?

The Stripe fee calculator works by calculating the total fees that will be charged by Stripe based on the total amount being charged to the customer. The calculator takes into account the standard Stripe fee of 2.9% plus the $0.30 per transaction processing fee.

21. Can the Stripe calculator be used for calculating individual payments?

Yes, the calculator can be used for calculating individual payments. Simply enter the amount being charged and the calculator will generate the total fees for that specific transaction.

22. Can I reduce my Stripe fees?

Yes, there are ways to reduce your Stripe fees. One way is to try and process as many payments as possible through bank transfers instead of credit cards, as bank transfers have a lower processing fee. Another way is to negotiate with Stripe for lower fees if your business processes a high volume of transactions.